Food Empire Holdings is a Singapore-based global food and beverage company known for its popular coffee and snack brands. With a growing international presence, many investors are curious about the Food Empire target price and how the company might perform in the near future.

What Is Food Empire?

Food Empire is famous for its flagship coffee brand, MacCoffee, and its presence in over 60 countries. The company has seen consistent growth in Eastern Europe, Central Asia, and Southeast Asia. This success has helped its share price remain attractive to many analysts and investors.

Why Food Empire’s Target Price Matters

The Food Empire target price reflects what analysts believe the stock will be worth in the future. It’s based on market trends, revenue forecasts, and company strategy. When the target price is higher than the current price, it often signals a good opportunity for investors.

Current Market Performance

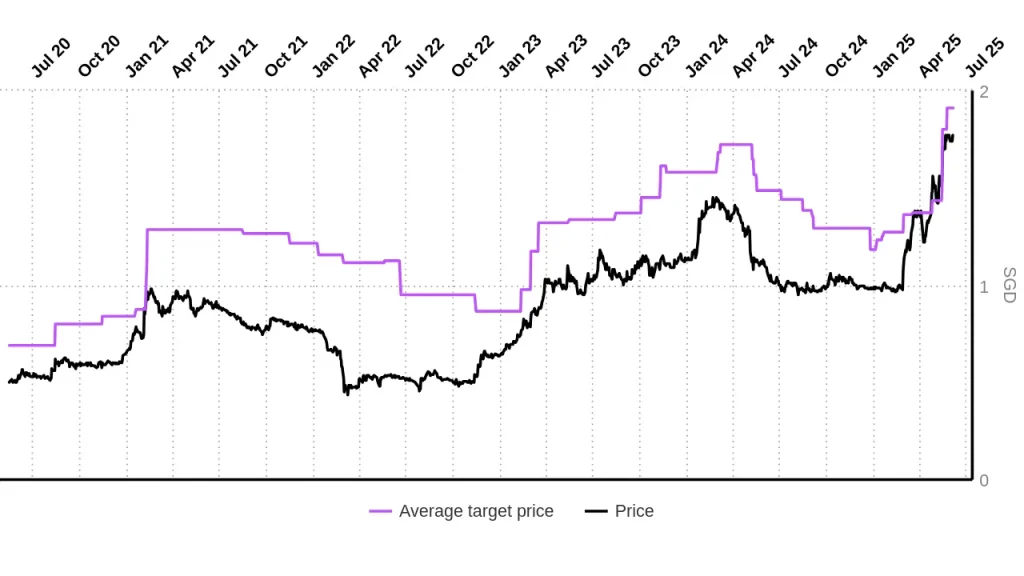

As of early June 2025, the stock trades around SGD 1.74. This price reflects stable investor confidence and a steady financial track record. Many analysts believe the stock has more room to grow, especially as the company expands further into new markets.

| Date | Broker | Rating | Target Price (SGD) |

|---|---|---|---|

| May 2025 | Maybank Securities | Buy | 2.00 |

| May 2025 | UOB Kay Hian | Buy | 1.98 |

| May 2025 | CGS International | Add | 1.95 |

| May 2025 | RHB Bank Singapore | Buy | 1.67 |

| May 2025 | KGI Securities | Outperform | 1.40 |

Average Target Price in 2025

Based on multiple analyst reviews, the average Food Empire target price is around SGD 1.79 to SGD 1.91. This shows a possible upside from current levels. Investors looking for steady returns may find this stock appealing given its stable growth and rising demand for instant coffee products globally.

Analyst Ratings and Their Meaning

Most analysts have rated the stock as “Buy” or “Add”. These ratings show strong trust in the company’s leadership, financial results, and brand strategy. Only a few have issued lower targets due to possible market risks or currency issues in Food Empire’s core markets.

Financial Highlights to Consider

Food Empire has shown steady performance in revenue and profits over recent quarters. The company has reduced operational costs and improved profit margins. Here are some key financial highlights:

| Financial Metric | Q1 2025 |

|---|---|

| Revenue | SGD 105 million |

| Net Profit | SGD 16 million |

| Earnings per Share (EPS) | SGD 0.086 |

These numbers play a key role in how analysts calculate the Food Empire target price. Positive earnings growth often supports a higher target.

Technical Forecasts and Stock Movement

Some stock analysis platforms like StockInvest suggest that Food Empire is a “Buy” candidate. Technical forecasts predict a possible rise toward SGD 2.33 to SGD 2.70 in the next three months. These predictions are based on market patterns and moving average trends. Technical indicators show that the stock is currently in a bullish zone. If buying interest continues, the price could move higher toward the top range of analyst targets.

Future Outlook for Food Empire

The company is expanding its presence in South Asia and the Middle East. This expansion may bring new revenue sources and help raise the Food Empire target price in the future. Also, the company is exploring healthier food product lines and sustainable packaging to appeal to modern consumers. Food Empire also plans to invest in digital marketing and supply chain technology. These steps can improve efficiency and brand value across markets.

Risks That Could Impact the Target Price

While the outlook is mostly positive, there are risks. Fluctuating currency rates in key markets like Russia and Ukraine can affect profits. Raw material costs, like coffee beans and packaging, may also put pressure on earnings. These factors could lower the Food Empire target price if not managed properly. Regulatory changes or political tension in foreign markets might also slow down company operations. Still, the company’s diverse market spread may reduce this risk over time.

When to Expect New Price Updates

Food Empire is expected to release its next earnings report around August 11, 2025. Investors and analysts will review the report closely to update their target prices. If results are better than expected, the Food Empire target price might rise in new analyst reports. Until then, many investors will watch how the company handles market challenges and continues its growth path. Strong earnings could result in upgraded ratings and higher valuations.

Conclusion

The Food Empire target price gives investors a clear idea of where the stock could go in 2025. Most estimates are higher than the current price, pointing to solid growth potential. The company’s strong product lineup, international presence, and financial discipline make it a stock worth watching. With analyst targets ranging from SGD 1.40 to SGD 2.00, the average still supports potential gains. As long as Food Empire continues its smart growth and manages risks wisely, investors may find value in holding or buying the stock now.